schedule c tax form calculator

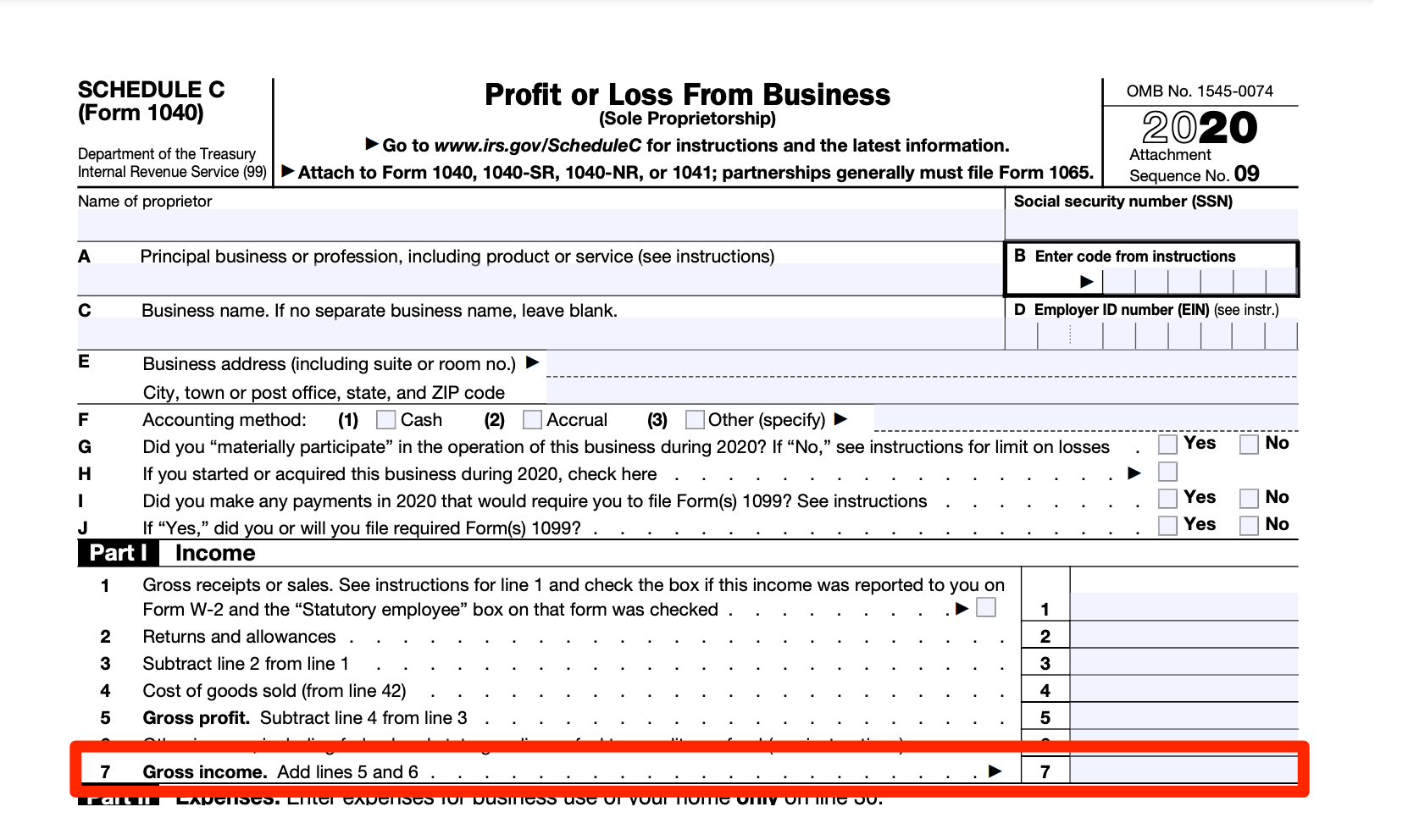

The form is titled Profit or Loss from Business Sole. This free tax calculator allows you to input your revenue your operating expenses and your additional deductible expenses and provides you with calculations for your net profit your self.

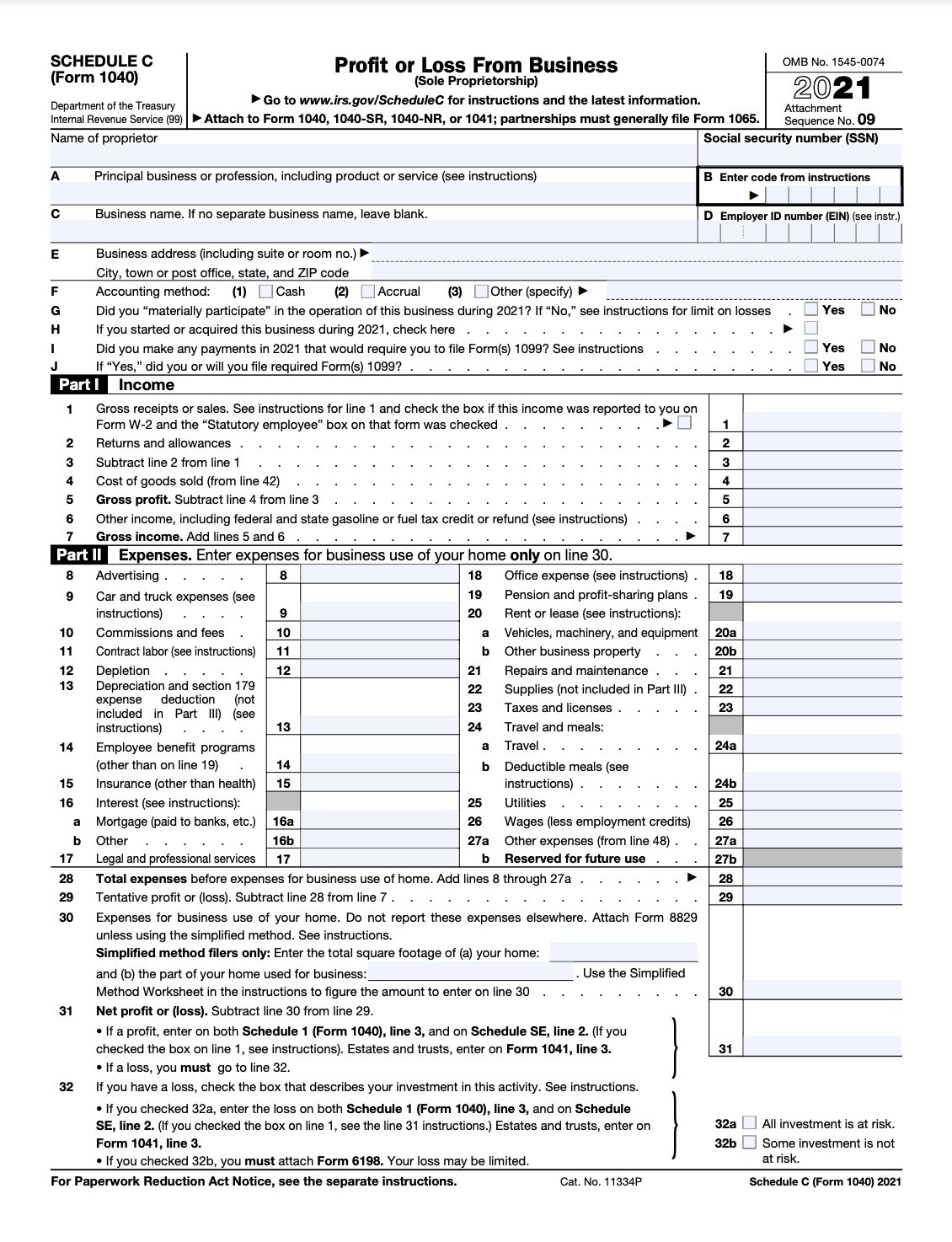

How To Fill Out Your 2021 Schedule C With Example

Buy now to be ready for taxes Overview Tax forms Estimated taxes Self-employment tax Schedule C Tax Calculator Maximize tax deductions Users have found hundreds of millions.

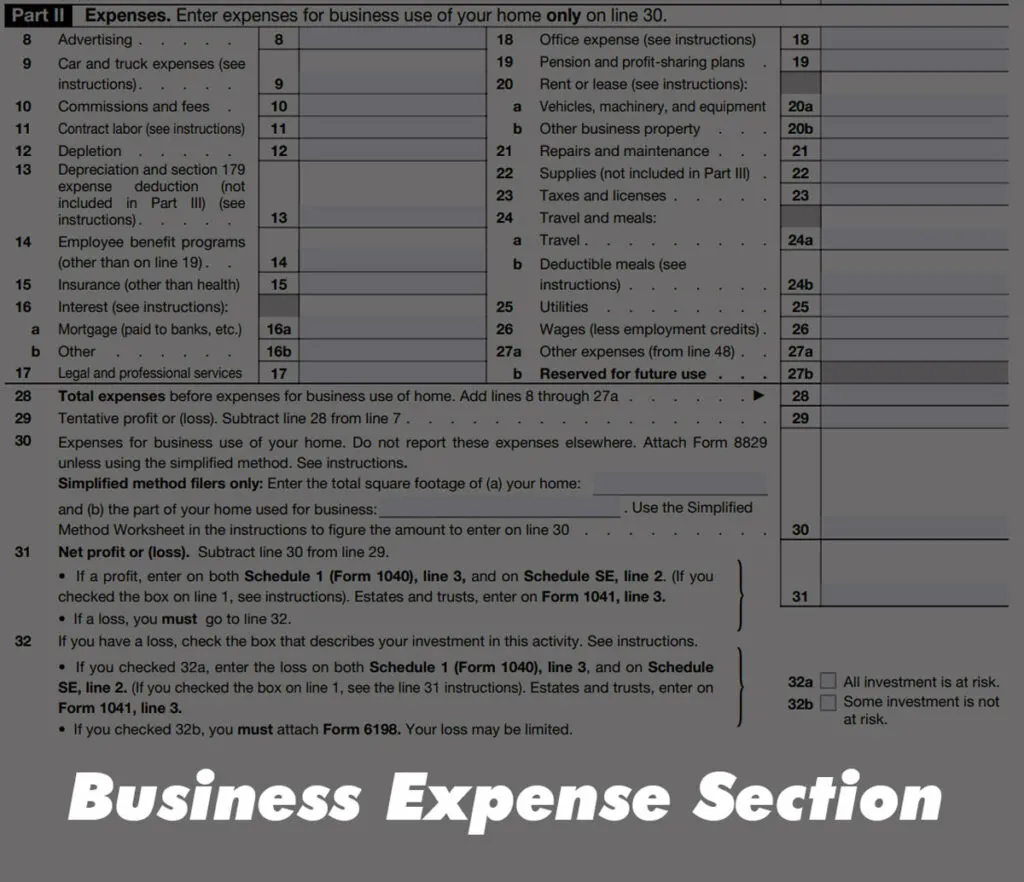

. Make tax season a breeze. If you have a loss check the box that describes your investment in this activity. Schedule C is a tax form used by most unincorporated sole proprietors to report their business income and expenses.

Youll also include it on Schedule SE to calculate your self-employment tax. The TaxAct program will automatically calculate this adjustment to self-employment earnings. The resulting profit or loss is typically.

Schedule C is used by small business owners and professionals who operate as sole proprietors to calculate their profit or loss for the tax year. Plan contributions for a self-employed individual are deducted on Form 1040 Schedule 1 on the line for self-employed SEP SIMPLE and qualified plans and not on the. Self-employment income is how we describe all earned income derived from non-W-2 sources.

After computing your current years depreciation deductions total them in Part IV of Form 4562 and copy the number to the Schedule C line for. Use this tool to. The IRS uses the.

What is Schedule C. Your net profit or loss goes on your main 1040 tax form as part of the income component. It is used by the United States Internal Revenue Service for.

Form 1041 line 3. If a loss you. If you file using a software install our plug-in and well tell you the numbers you should enter at every step to prepare your taxes.

Schedule C is part of Form 1040. The Schedule C Process. An Overview The process for completing Schedule C begins with gathering information.

Go to line 32 31 32. Complete the Process. Schedule C is a tax form for small business owners who are either a sole proprietor or have a single-member LLC.

If you have a tax advisor or. Income Tax Calculator The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Complete the form adding information and doing the.

A Schedule C is a supplemental form that will be used with a Form 1040. This form is known as a Profit or Loss from Business form. If you checked 32a enter the.

It is mainly intended for residents of the US. Schedule C is used to report self-employment income on a personal return. What is a Schedule C Tax Form.

IRS Schedule C Profit or Loss from Business is a tax form you file with your Form 1040 to report income and expenses for your business. Profit or Loss From Business Sole Proprietorship is used to report how much money you made or lost in a business you operated. An activity qualifies as a business if.

See how your refund take-home pay or tax due are affected by withholding amount. Youll add up all the expenses and subtract them from your gross profit to arrive at your net profit. How It Works.

Answer The Schedule C. That profit or loss is then. Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor.

Its used by sole proprietors to let the IRS know how much their business made or lost in the last year. Line 31 is your net profit or loss line 29 net profit or loss minus. Use Form 8829 to enter your calculation for the actual expenses method and attach it to your Schedule C.

And is based on. Its part of the individual tax return IRS form 1040. The instructions for Schedule C explain the rules for each type of expense.

Estimate your federal income tax withholding. You will see the following items on the Worksheet 4 titled Figuring Net Self-Employment Income for.

What Is A Schedule C Tax Form H R Block

Free 9 Sample Schedule C Forms In Pdf Ms Word

Free 9 Sample Schedule C Forms In Pdf Ms Word

How To Fill Out Your 2021 Schedule C With Example

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Free 9 Sample Schedule C Forms In Pdf Ms Word

Free 9 Sample Schedule C Forms In Pdf Ms Word

Free 9 Sample Schedule C Forms In Pdf Ms Word

What Do The Expense Entries On The Schedule C Mean Support

How To Fill Out Schedule C For Doordash Independent Contractors

Schedule C Instructions With Faqs

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet

What Is A Schedule C Tax Form H R Block

How To Fill Out Your 2021 Schedule C With Example

How To Calculate Gross Income For The Ppp Bench Accounting

How Much Did Your Parent Earn From Working In 2020 2022 23 Federal Student Aid